can you go to jail for not paying taxes in canada

For the court to pass a fair conviction under the violation of the United States of America Tax legislation the prosecutor will have to prove the following. The CRA is convicted of tax evasion the full amount that is due as well as interest and any civil fines are payable.

Four Ways To Legally Avoid Paying Us Income Tax

From the Canadian Revenue agency - Tax evasion.

. If passport is not surrendered as ordered time in jail may be ordered by Court. What are the consequences of tax evasion. When prosecuted for tax law violations and sentenced for them in court you cannot go to prison for any other offencesTax fraud and tax evasion are among the most common forms of tax crimeIt is criminal to willfully attempt to evade tax on an income basis.

This number of children need child support. The Canadian govt has given much importance to child support. This may have you wondering can you go to jail for not paying taxes.

However you cant go to jail for not having enough money to pay your taxes. Can You Go To Jail For Not Paying Taxes In Canada. Tax evasion is a crime.

A variety of tax penalties can be imposed by Canadas Income Tax Act and Excise Tax Act. Individuals and corporations proven to elude exercise by the court are eligible for a fine of about 100000 and 500000 respectively not to mention a jail sentence of up to 5 years. At first we want to say that if you are not paying child support you not doing a good thing.

If you owe tax debt and cannot pay the CRA can take strong collections action against you but it is not a crime and you cannot go to jail. There have 12 million divorced couples having a child in Canada. Jail time is an option as well as fines that can reach 200 of the amount omitted.

When taxpayers are convicted of tax evasion they must still repay the full amount of taxes owing plus interest and any civil penalties assessed by the cra. Under Section 238 of the Income Tax Act failure to file your tax return is punishable by a fine of 1000 25000 and a prison term of up to one year. This offence results in a fine of anywhere between 1000 and 25000 and up to one year in prison.

Can you go to jail in Canada for not paying taxes. And CRA does not hesitate to threaten to charge you with evasion. Taxes evasion must be met with harsh penalties.

Answer 1 of 4. In addition depending on the laws in the province in which the support is due failure to pay support may result in a jail sentence. The CRA convicted 128 people of tax evasion or tax fraud in fiscal year 2013 but only 29 of them or 23 per cent were sentenced to jail time.

Can you go to jail for not paying taxes in canada. It also wont protect you from criminal charges. Can You Go To Jail For Owing Taxes In Canada.

A tax return filed in violation of the law can result in jail time for prosecution. Can You Go To Jail For Not Paying Taxes Canada. Be guilty of a felony and upon conviction thereof shall be fined not more than 100000 500000 in the case of a corporation or imprisoned not more than 5 years or both.

There is no requirement to file income taxes in Canada unless you owe money or are asked to file by Canada Revenue Agency. Its obviously a crime and maybe you need to go to jail for this. Can You Go To Jail For Owing Taxes In Canada.

The IRS doesnt pursue many tax evasion cases for people who cant pay their taxes. You then file and in almos. The potential penalties for tax evasion Canada can be very severe.

You can go to jail for not filing your taxes. To better understand these distinctions take a closer look at when you risk jail time for failing to pay your taxes. If you work in any salaried position your employer would deduct income taxes off your pay and remit these to CRA automatically.

The courts can also impose fines as high as 200 of the tax evaded as well as jail terms of up to five years if they repeat the offence. In the event of a taxpayers conviction for tax evasion they will also have to repay the tax owing in full along with interest and any civil penalties that the CRA may impose. Under IRS Section 7201 Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall.

Besides fines and jail terms the courts can impose sentences of up to five years if they are convicted of tax evasion. Absolutely yes you can go to jail for not paying your taxes. However that doesnt mean that you cant face potential criminal charges.

The short answer is maybe. Yes you certainly can. If debt is related to tax evasion or other fraudulent tax activities remedies may include time in jail.

In terms of financial cost tax evasion is one aspect. Since tax evasion Canada is a very serious charge it is important that you file your taxes correctly. However a lot of people wonder if you can go to jail for tax debt.

You can go to jail for lying on your tax return. The reality is that owing money to the CRA is not illegal. Can You Go To Jail For Not Paying Cra.

You cannot be charged with a crime if you do not pay your taxes but those who fail to file their tax returns are considered tax evaders. Section 239 of the Income Tax Act indicates that those convicted of tax evasion could pay anywhere from half to double the amount that they were trying to save by cheating on their taxes.

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

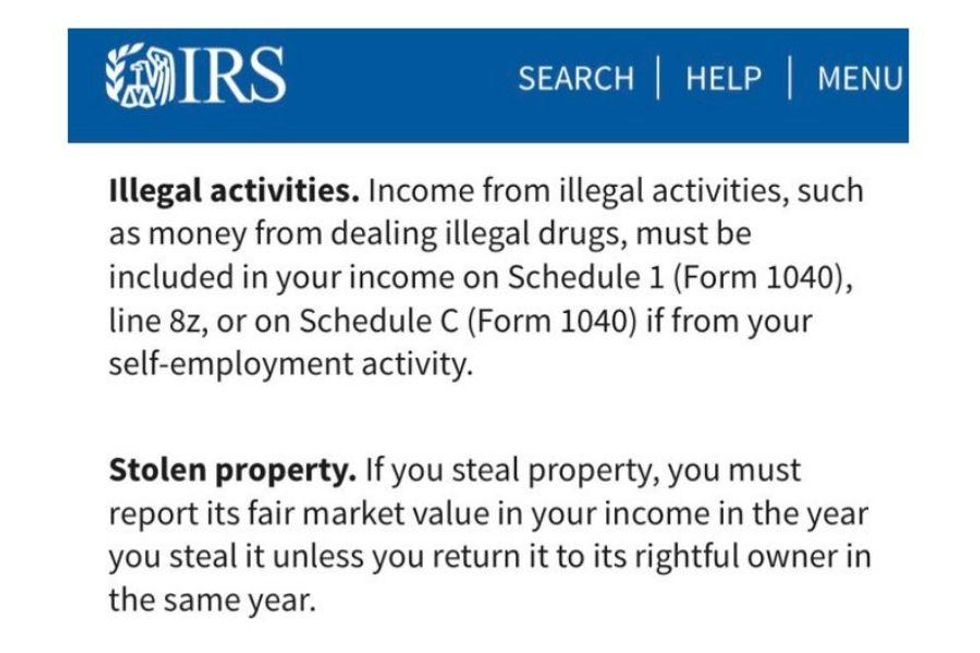

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Unknown Punster Taxes Humor Cat Jokes Funny Cats

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

What Is Tax Evasion It S A Crime Freshbooks

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

The Repercussions Of Not Paying Your Taxes To The Cra

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Can You Go To Jail For Not Paying Taxes Canada Ictsd Org

Is It Illegal To Not Pay Taxes In Canada Ictsd Org

Can You Go To Jail In Canada For Not Paying Income Taxes Quora

The Repercussions Of Not Paying Your Taxes To The Cra

Annuity Calculator For Excel Annuity Calculator Annuity Savings Calculator

/GettyImages-641141038-635672bd575846b5bfcb889f7665134e.jpg)